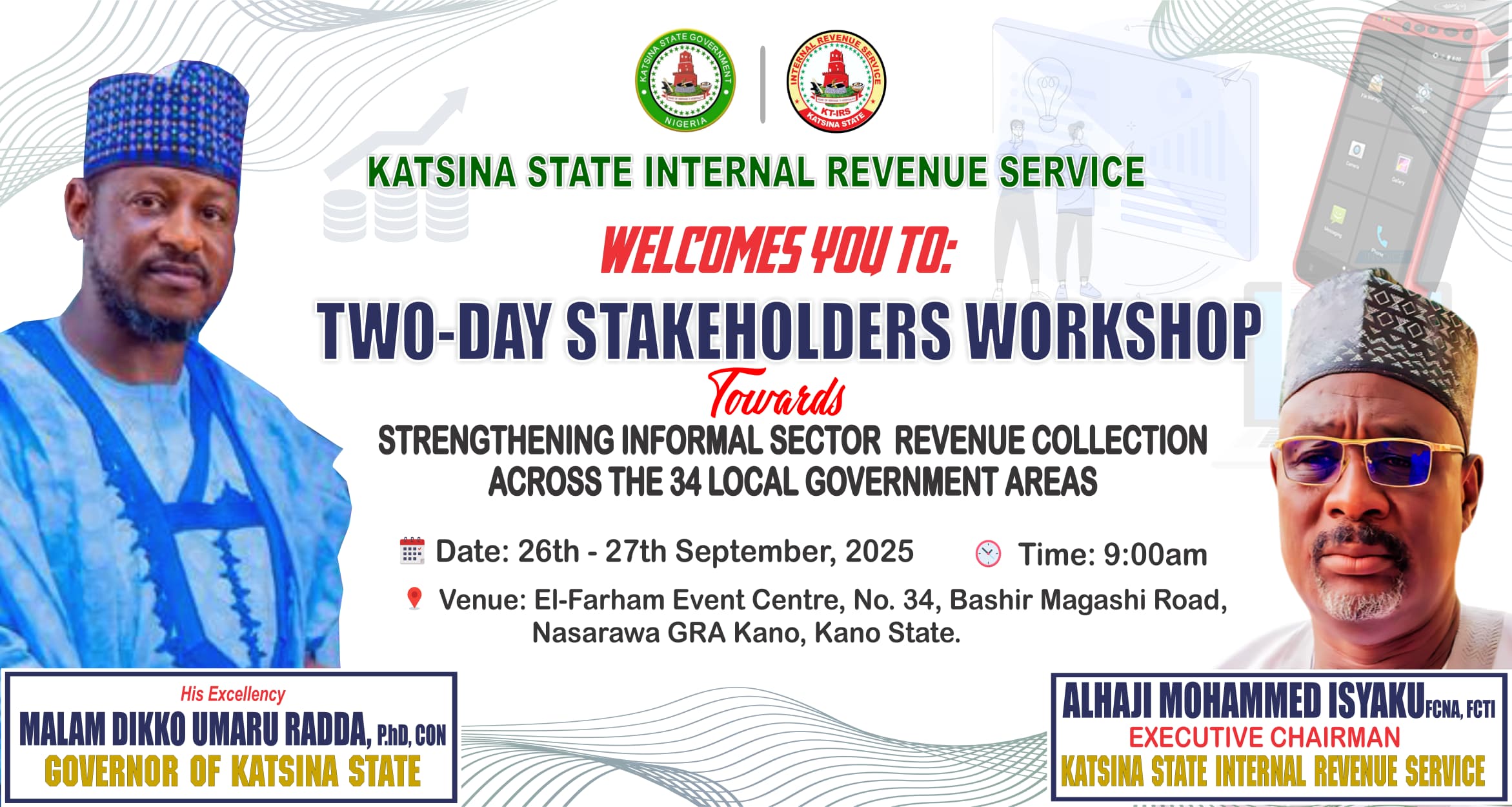

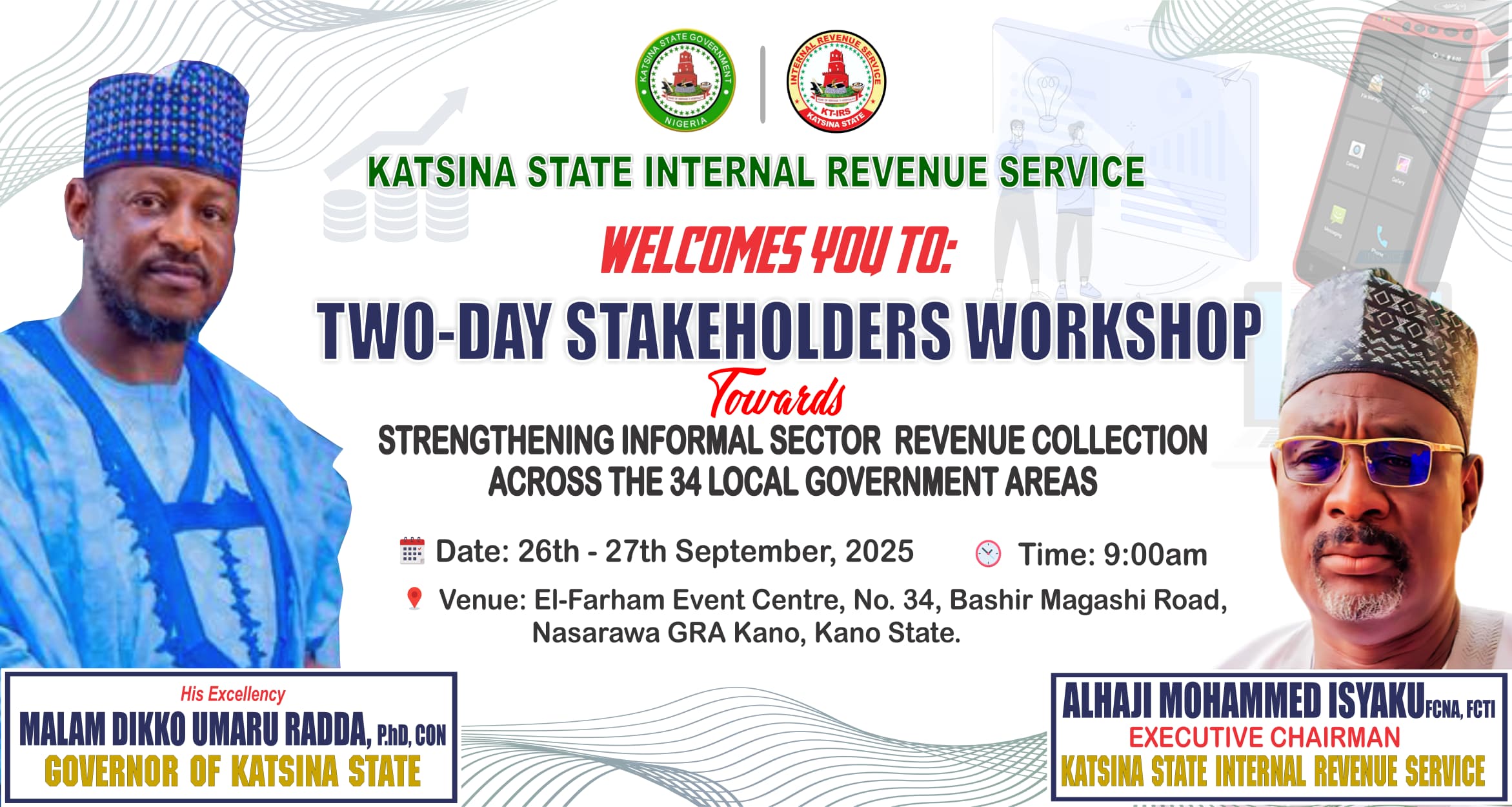

2-Day Workshop with LGA Chairmen

Strengthening informal sector revenue collection and preparing for the Nigeria Tax Act 2025.

Efficient Tax Services

Delivering world-class tax solutions in Katsina State.

Secure Tax Collection

We ensure secure and timely tax collection across the state.

Modern Tax System

Leveraging modern technology for seamless tax services.